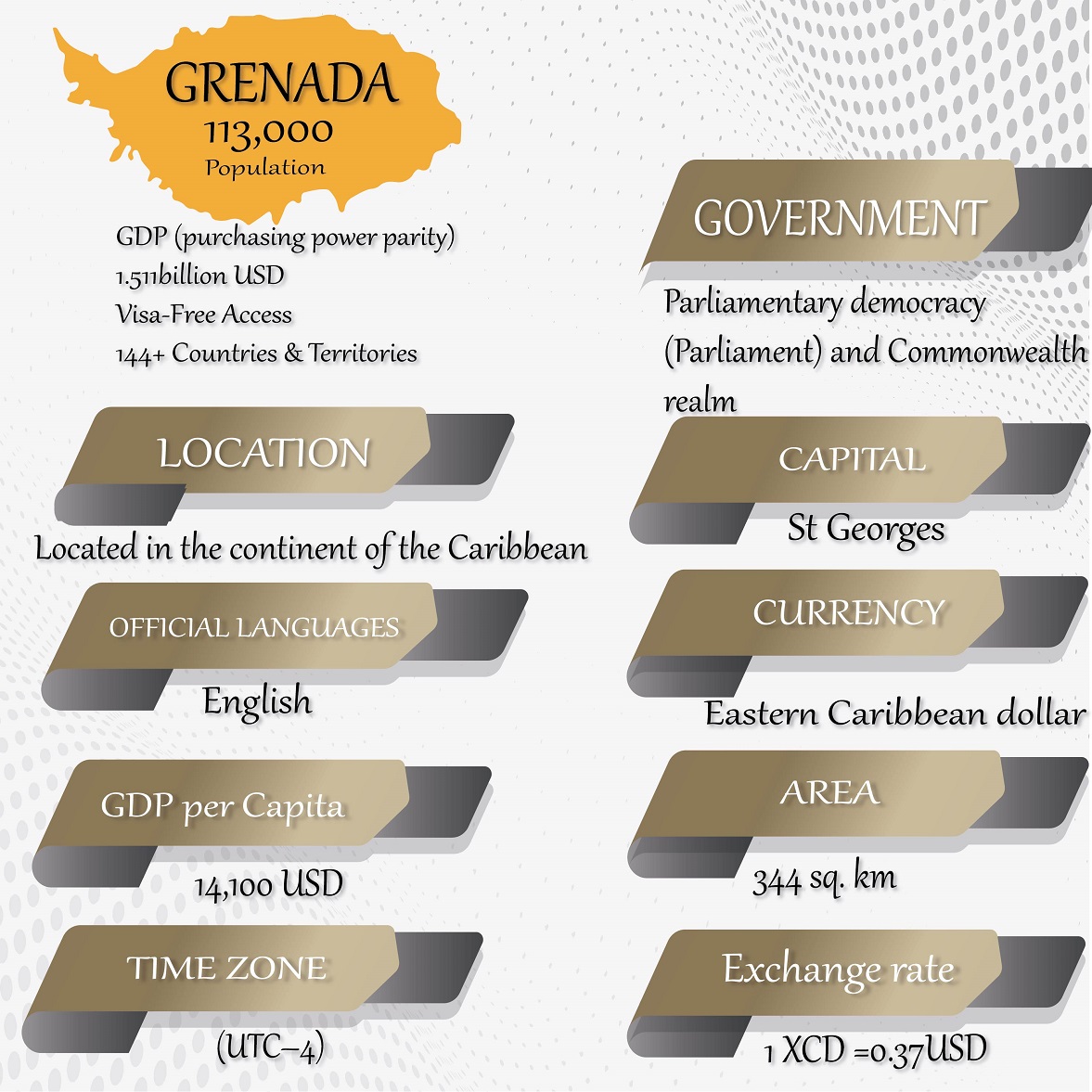

Grenada

Grenada is one of the most dazzlingly beautiful and sumptuous islands in the West Indies. It is termed as the ‘Spice Isle’ on account of its beauty. It is located between the Caribbean Sea and the North Atlantic Ocean, north of Trinidad and Tobago. Immaculate and exotic, Grenada’s scenery, tropical rain forests, waterfalls and golden beaches wills appeal to visitors from around the world. Tourism is a recent phenomenon here, so you will find many deserted beaches and enchanting scenery.

legal Bases

The Grenada Citizenship by Investment Program came into being in August 2013, when the Grenadian Parliament passed Act No. 15 of 2013, otherwise referred to as the ‘Grenada Citizenship by Investment Act, 2013.’ The stated objective of the Act is to “enable persons to acquire permanent residence and citizenship of Grenada by registration following investment in Grenada.”

Benefits

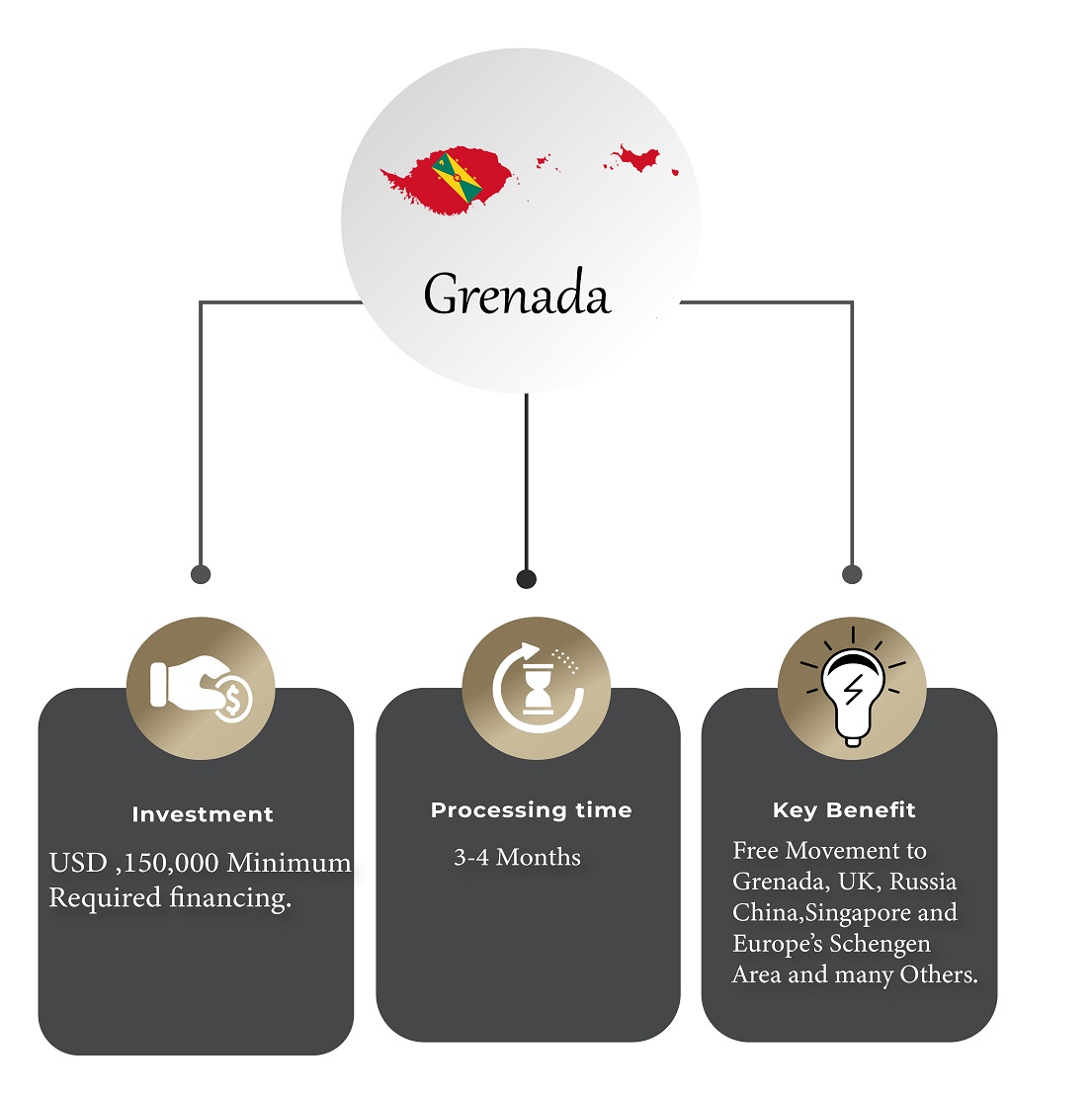

Visa-free access to 144 countries including the Schengen are, the UK, Singapore, China and Hong Kong.

- The only Caribbean country which offers citizenship-by-investment country and has visa-free access to China

- The only Caribbean country with a citizenship-by-investment program which holds an E-2 Investor

- Visa Treaty with the US, allowing citizens to be eligible to apply for a non-immigrant visa

- Citizenship may be passed down to future generations without restriction

- Lowest capital requirement in comparison to the other citizenship programs in St. Kitts and Nevis, Antigua and Barbuda.

- Fast and efficient application process of approximately three months from submission with no visit required

- Permanent lifetime citizenship, protected from changes in government

ELIGIBILITY

Eligible dependents include the spouse and children under the age of 25 years, as well as dependent parents above the age of 65.

Grenada INVESTMENT OPTIONS

The Grenada Citizenship by Investment Program requires applicants to either make a sizeable economic contribution to the country or to attain qualifying asset approved by the government. In exchange, and subject to a stringent vetting and due diligence process, including thorough background checks, the applicants and their families will be granted citizenship. To qualify for citizenship, the primary applicant must be over 18 years of age, fulfil the application requirements, and meet one of the two primary qualifying options:

National Transformation

National Transformation Fund donation option: A minimum contribution to the NTF of USD 150,000 for single applicants which is non-refundable

Real Estate

Real estate option: A purchase of at least USD 220,000 from a government-approved real estate project. An additional minimum non-refundable contribution of USD 50,000 applies for this option

TAXATION

- Under the Grenada Income Tax Act Cap. 149, the individual annual income tax rate is 15% up to XCD 24,000 and 30%. This income tax is applied on the amount in excess of XCD 24,000. The flat tax rate for companies is 30%. There is a withholding tax of 15%, which is compulsory to be withheld on any payments sent to a non-resident for interest (except from bank deposits), salaries, rent, lease premiums, licenses, royalties, management charges, commissions, and fees.

- VAT in Grenada is 15%, and property transfer tax for citizens is 5% which is payable by the vendor/seller. Annual taxes in Grenada include property tax, which is 0.2% of the market value for residential property, and stamp tax on business receipts, which is 0.75% if gross receipts are over XCD 300,000, and 0.5% on any amounts lower then this set threshold. The first XCD 37,000 is exempted from annual stamp tax.

Application Process

Step 1

The application process for Grenadian citizenship is efficient and lacks complexity, and the applicant is not required to visit Grenada for the completion of the process.

Step 2

The Grenadian citizenship by investment application pack will be delivered to you by Henley & Partners. It will include all the pertinent documentation, accompanied by detailed instructions. Once everything is returned to us, we will double-check the application to ensure completeness and accuracy to minimize any possibility of rejection.

Step 3

Once an application is submitted, the government generally responds to the applicant within a period of 90 days. Passports for successful applicants will be issued within 10 working days. Applicants are not required to collect their passports in person. Henley & Partners will coordinate the collection process and send the passport(s) to the client.

Step 4

Under the real estate option, the time frame may vary depending upon the project. Therefore, it is important to select a real estate project that is able to provide the necessary paperwork from the developer. Henley & Partners will guide you in this connection.